These are among the major findings in the new 2025 State of the Industry report from EV charging association ChargeUp Europe.

Despite discussion of public charging dominating the public and regulatory debate, it is in private settings – whether residential, workplace, or depots – where most EV charging takes place.

By the end of 2024, there were 7.5 million private charging points across the EU, meaning that more than 9 in 10 charging points are in private locations. By 2035, nearly 37 million private chargers will be in place, empowering individuals and businesses to control, optimise, and even profit from their energy use.

ChargeUp Europe says the private charging landscape is evolving rapidly, particularly through smart charging and load management solutions. These technologies optimise electricity usage by balancing demand with grid capacity, helping EV drivers charge their vehicles at the most cost-effective times and take maximum advantage of locally produced renewable energy, opening the door to further enhancing financial savings.

By 2035, 37 million private charging points are expected to be in place, 85% of which will be residential. Corporate infrastructure is set to grow at a faster rate than residential, from 0.8 to 5.3 million charging points.

Private charging points will require about 90 TWh by 2035 – the majority of total EV charging demand – which can be managed via smart charging solutions.

Infrastructure subsidies

ChargeUp Europe’s infrastructure forecast highlights the growing importance of private charging, and some countries have introduced incentives for home chargers and EV purchases to support electrification. Infrastructure subsidies facilitate people switching to EVs by removing a barrier to going electric.

In France, the Advenir programme for charging infrastructure has contributed to the large increase in EV sales. Since its introduction in 2016, EV registrations have grown by 49% on average year-on-year.

Similarly, with the Moves III subsidy, EV registrations in Spain have increased by 48% year-on-year.

EV charging and EU energy consumption

ChargeUp Europe says EV charging represents a miniscule amount of EU energy consumption.

Europe’s total electricity demand is expected to increase by 37% over the next decade, while demand from EVs is projected to grow nearly sixfold. Yet, even with this sharp rise in EV adoption, their electricity consumption will remain relatively small.

“Today, EV charging represents just 0.6% of total electricity demand, and by 2035, this is expected to rise to only 3.5% - still a miniscule share of Europe’s overall electricity use,” ChargeUp Europe states.

“By 2030, Europe's EV's fleet will be able to store 114 TWh of electricity and serve as a distributed energy storage centre.”

Charging in single-family homes

Compleo took part in a project that explored how bidirectional charging can contribute to energy flexibility, self-consumption, and grid services. The challenge was to enable seamless operation between EVs, chargers, energy management systems, and DSOs, while ensuring user-friendliness and system reliability.

ChargeUp Europe says the results demonstrated potential for end-user savings of €100-500/year from optimised self-consumption and a reduced required storage investment by up to 50% across Europe by 2040. Some of the lessons learned are that customer incentives are important, as monetary reward drives participation, and that interoperability across components (i.e. EV, charger, EMS) is critical for scalable rollout.

Multi-unit dwellings

As e-mobility becomes more mainstream, the EV user base is expanding to include more residents of large apartment buildings.

The EV charging industry offers a range of solutions for those living in multi-unit dwellings. Some residents may opt for a single charger for their personal use, and others may work with a provider for building-wide installation.

However, not all EV drivers have access to a designated parking space and may instead use workplace or public AC charging.

ChargeUp Europe says EU Member States should transpose the Energy Performance of Buildings Directive (EPBD). This would streamline the cabling process for building installations, help optimise buildings' electricity use, and ensure charging points are capable of smart charging. Implementation of the Right to Plug would reduce the obstacle posed by tenant assembly approval processes, a common bottleneck for EV installations in multi-unit dwellings.

Workplace charging

Workplace charging points see slightly higher utilisation than residential ones, averaging 3.2 sessions per week compared to 2.8.

ChargeUp Europe says that, when employees use a company car as a ‘benefit in kind’ and charge it at home, they should be reimbursed for electricity costs. This setup involves multiple parties and creates VAT and payment regulation challenges across the EU. “Member States and the EU should simplify VAT rules for home charging reimbursements to reduce complexity,” the association adds.

Roche, a global player in the pharmaceutical and diagnostics sectors, says that a key pillar of its strategy is the development of workplace charging infrastructure, with 114 charging points installed at their Italian headquarters. This has made electric mobility a concrete, practical, and cost-effective solution, optimising operational efficiency and allowing fleet drivers to charge onsite and reduce costs.

With over 6,600 charging sessions onsite and 264,782 kg of CO2 saved, Roche Italia stands as a model for sustainable corporate mobility, demonstrating a clear commitment to reducing environmental impact. Since 2022, Roche has expanded its efforts by granting employees with private electric vehicles access to company charging stations at preferential rates, encouraging more people to transition to e-mobility.

The project is further strengthened by 77 home-installed wallboxes and access to 950,000 public charging points across Europe, ensuring seamless charging flexibility

Corporate fleet potential

Corporate fleets (including leasing, rental and company cars) play a key role in the EU’s transition to zero-emission mobility, accounting for approximately 60% of all new car registrations in 2024. However, this potential remains underutilised. In 2023, just 12.3% of new corporate car registrations were EVs, compared to a 14.1% share among private buyers. While the gap narrowed slightly in 2024 (12.4% corporate vs. 13.8% private), the trend highlights missed opportunities in corporate electrification.

According to AFRY modelling, if fleets electrified at the same rate as private buyers, there would be an additional 9 million BEVs on EU roads by 2035. In Germany alone, this would result in 3 million more second-hand BEVs.

ChargeUp Europe says that Belgium had a very successful and holistic EV supporting framework, which included generous tax incentives for EV purchases and related expenses, support for both public and home-based charging infrastructure, and income tax deductions for energy supply. It adds that Member States should adopt equally holistic and supportive frameworks for their country.

Large fleets are electrifying

Edenred, jointly with Spirii, a global EV charging platform and solutions provider (acquired by Edenred in 2024), provide turnkey solutions to charge fleets at work and at home. Spirii is supporting a major Danish healthcare company in electrifying its entire patient transportation fleet.

The company, with approximately 10,000 employees and a fleet of 620 passenger cars in Denmark, currently operates around 115 electric vehicles and, in collaboration with Spirii, has deployed 170 charging points to date – 35% at depots and 65% as home chargers.

Key priorities for the company include:

- A sustainable fleet transition while maintaining full operational capacity and enabling business growth through new tenders

- Business continuity, with strict SLAs and best-in-class first-, second-, and third-line support

- A single point of contact for seamless, turnkey solution management and support

Logistics

InPost, a leader in logistics solutions for the e-commerce industry in Europe, is transitioning its vehicle fleet to electric and GreenWay (GW) is providing the charging solutions to support this transition, which already numbers over 1200 EVs.

GW’s solutions involve installing and operating smart EV charging infrastructure and dynamic energy management (EMS) at InPost depots, and providing access to GW’s wide network of public fast and ultra-fast charging stations. InPost drivers can reserve time at a public GW station to avoid expensive downtime.

The operational needs of InPost’s fleet at each depot vary. Some locations are better served with more low-power AC chargers for overnight charging and some are better served with high- power DC fast chargers as the vehicles recharge during short stops at the depot.

GW’s EMS optimises the power usage at each depot and redistributes available power as needed.

At one location, there is a connection capacity of around 120 kW for EV charging, which would permit the installation of only five 2x22 kW AC chargers and one 60 kW DC charger. Thanks to the use of the EMS, an additional 11 AC charging stations, one 60 kW DC, and one 100 kW DC station are supported at the site.

The EMS minimises the need for infrastructure upgrades, for additional contracted power, and reduces current-carrying requirements of electrical circuits supplying the charging stations.

GW provides fleet managers with detailed reports on energy usage they can use in their planning.

To date, GW operates 481 AC charging points and 64 DC charging points at 53 InPost locations around Poland, most of which are supported by GW’s EMS.

Public charging becomes more widespread

ChargeUp Europe says public charging is becoming more widespread and convenient, with increased offerings and services in response to EV driver preferences.

Contributing to this progress is the growing availability of DC and high- power charging (HPC) stations, which serve more users and significantly reduce charging times.

At the end of Q1 2025, there were roughly 950,000 public charging points across the EU-27, and this number is expected to grow to 2.2 million over the next decade. The expansion of public charging infrastructure has kept pace with EV adoption and has even exceeded the Alternative Fuels Infrastructure Regulation's (AFIR) installed capacity per BEV requirement by more than 4 times.

In countries with strong government support and inter-governmental coordination, bottlenecks get resolved and infrastructure has been deployed especially quickly. To maintain this momentum, continued policy clarity and a stable, predictable CO2 target framework are essential.

As EV adoption expands, so too does the infrastructure needed to support it. Over the past decade, public charging infrastructure has grown at an average annual rate of 39%, resulting in an overall increase of 1,660% since 2015.

Even more impressively, since 2020, the number of public charging points has grown over 4.5 times, significantly improving EV drivers' access to charging.

The deployment of DC fast chargers has surged, reaching over 135,000 charging points in 2024, which far outpaces the growth of AC chargers.

ChargeUp Europe says this trend reflects a growing demand for faster charging in public spaces, enhancing convenience for EV users.

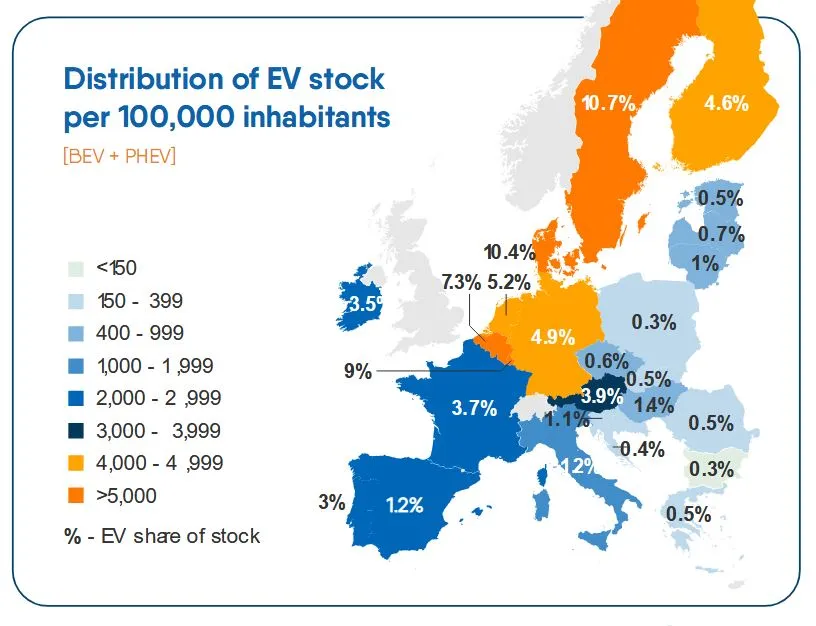

The association says EV charger density is increasing considerably. At the national level, the Netherlands, Belgium, and Denmark lead in charging point availability relative to population, with 6 to 10 public charging points per 1,000 people.

Across the EU, the average number of public charging points has risen to 193 per 100,000 inhabitants – an 82% increase since 2022. This growing density of charging infrastructure is being seen throughout Europe, with particularly notable gains in Estonia, Italy, and Belgium.

Over the next decade, public charging infrastructure is expected to increase by over 250%. Both AC and DC charging points will continue to be deployed, and DC charging will be increasingly deployed at a faster rate than AC. Source: ChargeUp Europe

Simplifying payments

Gireve’s clients can now process payments and track invoice settlements directly on the platform.

To ensure the most seamless experience for EV drivers within a fragmented charging market, CPOs and eMSPs are increasing the number of technical connections. In doing so, they have to handle multiple clearing transactions and cover invoicing and payments for all charging sessions. This leads to more complex operations and processes are often manual and inefficient.

Roaming platforms focus on simplifying those processes, and with over 20 automatic controls on each CDR, Gireve detects errors before the invoicing process. Operators can process payments and track invoice settlements directly on the platform.

This process is available for all roaming connections and its payment processing services follow the ongoing PSD2 and upcoming PSD3 regulations.

Electrification of eHDVs

While still in its early stages, ChargeUp Europe says the electrification of heavy duty vehicles (HDVs) is gaining momentum. In 2024, there were 25,000 electric trucks on European roads, a number predicted to increase nine-fold by 2030 and surpass 1 million by 2035. BEV technology is currently the most advanced and widely adopted option in the HDV sector.

Today, eHDVs primarily undertake short- and medium-haul journeys supported by depot charging, but as ultra-fast and megawatt charging infrastructure becomes more widely available, long-haul journeys will become increasingly common.

Despite many advancements over the last few years, truck electrification remains in its initial stages and still requires support. According to fleet managers, the biggest barrier is the price of eHDVs, which has prevented many companies, especially small to mid-sized ones, from acquiring eHDVs. In turn, this hesitation creates delays in the deployment of e-truck charging infrastructure. Policy support could ease this burden by providing purchase subsidies, incentivising companies to switch to eHDVs.

The next phase of charging

Lucie Mattera, secretary general of ChargeUp Europe, says: “As we look to the next phase of Europe’s transition to e-mobility, it is clear that the EV charging sector has moved beyond proving its worth – it is now an indispensable pillar of the continent’s ever more connected transport, digital and energy systems.

“But unlocking the full potential of electrification will not happen by standing still. A competitive, open, and interoperable market remains the cornerstone of user trust and investment certainty; forward- looking, harmonised policies that prioritise scale, smart integration, and system-wide efficiency are also required.

“Our sector stands ready to deliver. The evidence is clear: infrastructure growth is keeping pace with EV uptake, smart charging is maturing, and innovative business models continue to emerge.

“Yet key barriers remain. Grid connections are still a bottleneck, integration with the rest of the e- mobility chain, from grids to vehicles, remains incomplete, while regulatory fragmentation undermines scaling.

“Policy stability is paramount, but Europe also needs a coordinated push that empowers charging network providers to balance deployment and profitability, unlock investment, and integrate with the broader clean energy transition."

She concludes: “ChargeUp Europe will continue to serve as the voice of the charging industry, ensuring that our collective expertise shapes pragmatic, future- facing policies. Together with our members and partners, we are building the infrastructure of the future. Our vision is a seamless, smart, and reliable charging network that powers every journey. The work ahead is complex, but the opportunity is greater still. Let’s charge ahead – faster, together.”