The U.S. House of Representatives has recently passed the budget reconciliation bill, proposing to dismantle all of the tax credits that supporters say are creating momentum and opportunity for US EV and charging industry.

EV adoption non-profit organization the Electrification Coalition says that if the bill is approved by Congress it "takes a sledgehammer to the US EV industry".

The credits that would be cut include a 30% credit up to US$100,000 per single item or US$1,000 for eligible home refueling infrastructure.

The bill would also cut a number of other tax credits related to EVs.

Up to US$7,500 for the purchase of an eligible new EV (the bill provides an exception for vehicles from manufacturers that have not sold 200,000 vehicles placed in service by the end of 2026).

Support for a percentage of the cost of producing certain technologies (the bill would phase it out by 2028 with additional foreign entity of concern [FEOC] requirements).

Providing up to U$7,500 for the purchase of eligible commercial EVs under 14,000 lbs. and up to $40,000 for those over 14,000 lbs. (the bill provides an exception that will allow for tax credits to be taken for purchases with a binding contract signed before May 12, 2025 and placed in service by December 31, 2032).

Providing up to S$4,000 for the purchase of an eligible used EV.

The bill also creates a new Car Tax targeting owners of EVs and hybrid vehicles with an annual tax of US$250 and US$100, respectively.

Electrification Coalition executive director Ben Prochazka commented: “When considering the budget reconciliation bill, Congress is faced with a choice: Will the United States continue to lead in the automotive industry, or will we cede control to China?"

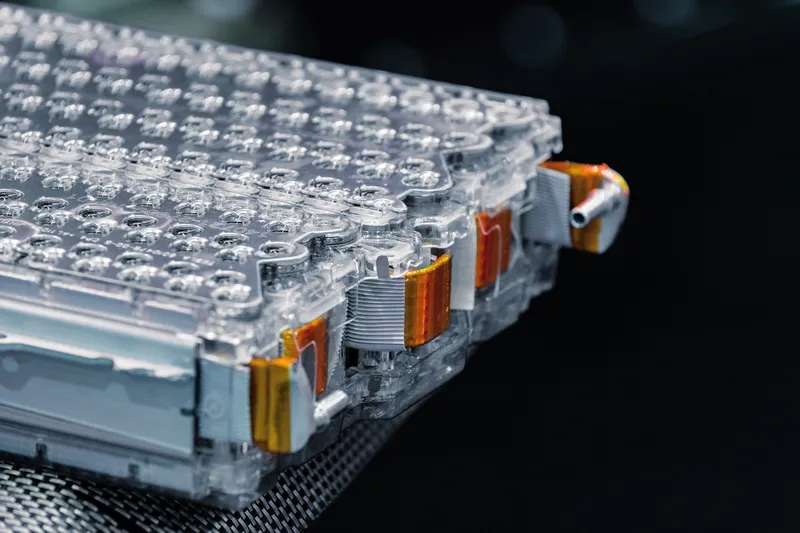

He added that the bill undermines efforts to build robust, secure and reliable access to critical minerals.

"It would eliminate critical tax credits that are spurring private-sector investments, supporting critical mineral supply chain development, creating American jobs and ensuring the United States remains competitive in the global automotive market," said Prochazka. "Removing these credits would pull the rug out from under the auto industry and other industries related to EVs at a critical time, immediately putting American jobs at risk. The industry needs policy certainty and consistency to build domestic and allied supply chains.

“In an April 15 executive order, President Trump identified critical minerals and the derivative products that support demand for minerals — including EVs — as ‘foundational to United States national security and defense.’ However, the provisions included in the budget reconciliation bill would reduce U.S. demand for critical minerals, putting our nation at greater risk.

“These tax credits are boosting American innovation and reshoring jobs in the rapidly growing EV sector, having already created over 228,000 jobs and drawn in more than $200 billion in private investments. This bill puts those jobs and investments at risk. States and communities would have benefited from these investments for years to come. As this bill heads to the Senate, we urge a more balanced approach."

Prochazka added that China, meanwhile, has been investing hundreds of billions of dollars in the EV sector for nearly 20 years, putting the United States at a competitive disadvantage. He said that ending these investments now will put the US further behind in the global shift to EVs.

“At the same time, Congress is also considering a $250 annual federal Car Tax on EVs," said Prochazka. "While all drivers should pay their fair share, this proposal is nearly three times what the average driver pays in federal gas taxes, which have not covered the cost of infrastructure for nearly 20 years. Rather than imposing a punitive tax on a subset of Americans, Congress should identify a fuel-neutral solution to the Highway Trust Fund’s structural insolvency.

“We strongly encourage the Senate to stand up and lead to preserve the 30D, 30C, 45X, 45W, and 25E tax credits to ensure that the United States dominates the global auto market.”