Amid a backdrop of political and macroeconomic uncertainty, global electric vehicle use has shown steady growth over the last two years, although this varies strongly across regions.

Strategy consultancy Roland Berger’s EV Charging Index 2025, which comprises primary research and a survey of 12,000 respondents in 33 markets, ranks China, Norway, and the United States as the top three market leaders. The Index is based on metrics including EV sales, charging infrastructure, industry innovation, and customer satisfaction. While Germany’s fall in EV sales has seen it slip down the rankings over the last two years, other nations have risen swiftly.

The UK is now fourth, thanks to strong growth in EV sales and charging infrastructure, while Portugal and Turkey have each jumped into the top half of the Index. South Korea remains a strong player in the EV market, but its overall ranking is declining, largely due to low customer satisfaction with the country’s charging network. Romania’s ranking has also fallen as EV sales growth has stalled.

“Global e-mobility growth progressed steadily, albeit with considerable regional variation. Cost headwinds, battery supply chain issues, and public policy changes led to modest EV sales growth in much of Europe, while political uncertainty is slowing progress in the United States,” says Adam Healy, principal at Roland Berger. “By contrast, China continues to prioritize electrification and younger markets in both the Middle East and Southeast Asia saw substantial growth in EV adoption rates.”

China again leads way in e-mobility

China tops the EV Charging Index as it continues to expand its sizeable EV parc while excelling in charging provision. Meanwhile, first mover countries such as Norway and the Netherlands retain their places high up in the index, and other early follower markets such as France and the UK have gained ground, while younger markets in Southeast Asia (including Thailand and Indonesia) have taken great strides over the last two years. It’s a similar story in the Middle East and emerging markets like Brazil and India, suggesting that what these nations may lack in EV sales penetration, they make up for in improvements in charging provision, technology, and user satisfaction.

EVs increasingly used as everyday vehicles

Environmental protection remains the leading driver of EV adoption, but it now sits alongside the perception that EVs offer lower operating costs than ICE vehicles. In Asia-Pacific and North America, operating costs have overtaken the green case for using an EV.

In support of this, more than three quarters of EV users (80%) report driving 10,000 kilometers or more each year, while 73% use their EVs at least four days a week. This paints a clear picture: Electric cars are increasingly becoming everyday vehicles.

As EVs become more widespread, user profiles continue to diversify. Use of home charging shows a minor decrease, falling from 87% in the 2024 Index to 85% of respondents this time. This is consistent with the gradual shift away from the archetypal early EV adopters with a private charging on their own property. On a global level, EV drivers conduct around half their charging away from home.

“All charging types and use cases remain important parts of the charging mix and fundamental components of user-friendly charging provision across the globe,” says Martin Weissbart, partner at Roland Berger. “Charge point operators need to keep this in mind while addressing users’ wishes for more, higher-power infrastructure.”

Europe: EV growth softens

Sales penetration rates paint a mixed picture in Europe. Over 2.7 million new passenger car EVs were sold in 2024 – more than 15% of all new car sales, although this was broadly similar to 2023. As a result, overall penetration in the continent's vehicle parc approached 5%, meaning around one in 20 cars on the road in Europe is now an EV, with the majority BEVs. But with cost headwinds and battery supply chain issues remaining, this growth was in line with our more conservative forecasts.

At a country level, EV sales penetration rates crept up in markets such as Belgium, the UK, and Portugal as consumer perception continues to shift, costs fall, and charging infrastructure improves.

However, rates remained stagnant or declined slightly in numerous others, including France, Italy, and Romania. Germany saw its second consecutive fall following a key policy change in late 2023, which saw the removal of national BEV purchase subsidies.

Looking ahead, the relaxation of emissions regulations at EU level results in a slightly softer outlook across some European markets for EV uptake than was previously forecast over the next two to three years. However, this will likely have little impact on electrification in the long term.

Beyond the major change to German EV subsidies enacted in January 2024, developments in national and local policy elsewhere have been mixed. On the positive side, Austria's Klimafahrplan aims to make all newly registered passenger cars in Vienna emission-free by 2030. Meanwhile, Hungary has received funding from the REPowerEU plan to improve charge point coverage, and Romania will increase its BEV subsidy to EUR7,500.

However, Switzerland rejected a new national funding program for charger installations in apartment buildings and parking lots. And, in the Netherlands, tax breaks for EVs will end in 2025, signaling a gradual tax increase from 2026 – earlier than expected.

The relaxation of emissions regulations at EU level results in a slightly softer outlook across some European markets for EV uptake over the next two to three years.

North America: Steady sales growth but political headwinds beckon

EV sales penetration rates increased across the North America region, with the United States ticking up from 10% to 11%, while Canada rose from 9% to 15% and the nascent Mexican market grew from 1% to 2%.

Despite a slowdown in the growth rate, volume continued to expand across the region, with more than 1.9 million new passenger car EVs sold in 2024, up from 1.6 million in 2023. Key drivers include the availability of new models and reduced pricing as well as rebates from the Inflation Reduction Act (IRA for the United States).

These factors have also contributed to an increase in EV leasing. The IRA allows EV leases to qualify for a USD 7,500 tax credit – more appealing than outright purchases and loans, which have more onerous qualification criteria. This funding has allowed dealers to offer attractive monthly leasing payments.

Crucially, the change of administration in the United States has placed doubt on future sales growth for EVs. Federal support is being rapidly withdrawn, while tailpipe emissions regulations are becoming looser.

Currently under consideration, the "Big Beautiful Bill" would remove all EV-related rebates and incentives covered by the IRA – potentially by the end of 2025. Meanwhile, in May 2025, Congress voted to remove a waiver that allowed the California Air Resources Board to set emissions regulations that are stricter than national requirements (Advanced Clean Cars and Advanced Clean Trucks). The matter is now subject to a legal dispute. Whether the waiver is allowed to remain until things are resolved is unclear.

That's not all: of greater importance to OEMs is the turbulent tariff situation, which will have a greater impact than changes to EV rebates. We expect EV sales growth to continue, albeit at a moderate pace with an increased share of PHEVs.

Asia-Pacific: Sales penetration varies strongly as growth continues

Regional growth in sales penetration rates was broadly strong across Asia-Pacific, although market maturity varies considerably. EVs represented 49% of new car sales in China, up from 36% in 2023. Thailand, Vietnam, and Singapore all registered EV sales penetration rates of at least 20%, while rates remained steady but low in Japan (4%) and India (2%).

The region is incredibly diverse, with numerous reasons behind the divergence in EV adoption. In China, the clear regional leader, electrification has now been a strategic priority for the government for many years, and this is where over 90% of regional EV sales volumes remain, with more than 11 million new passenger car EVs sold in 2024.

Among its most successful policies is the trade-in subsidy scheme, which has been renewed for 2025 after receiving more than four million applications in 2024. It offers subsidies of up to RMB 20,000 (USD 2,730).

Looking ahead, the Ministry of Industry and Information Technology has proposed draft legislation setting mandatory EV sales targets for automakers: 48% in 2026 and 58% by 2027. Concurrently, massive investments continue in charging infrastructure, aiming to support 20 million EVs by 2025, reduce range anxiety, and enable mass adoption.

Meanwhile, in Japan, EV penetration in new car sales remained between 3-4% for the third year running. The reasons for this are multifaceted, but one factor is the high proportion of Japanese living in apartment complexes, resulting in limited access to private charging facilities.

This is coupled with a perceived lack of development in public charging infrastructure, although this is now being addressed by increased government investment and supportive policy.

Among Asian markets, Japan stands out with only 78% of respondents considering a BEV as their next vehicle; this is relatively low for the region but broadly in line with some other countries. This metric is below 80% for respondents from the likes of Austria, Switzerland, Italy, Spain, and Romania, for instance. These are markets that are less mature, or where consumers have a less positive perception of EVs and charging infrastructure, or where recent policy developments have created uncertainty.

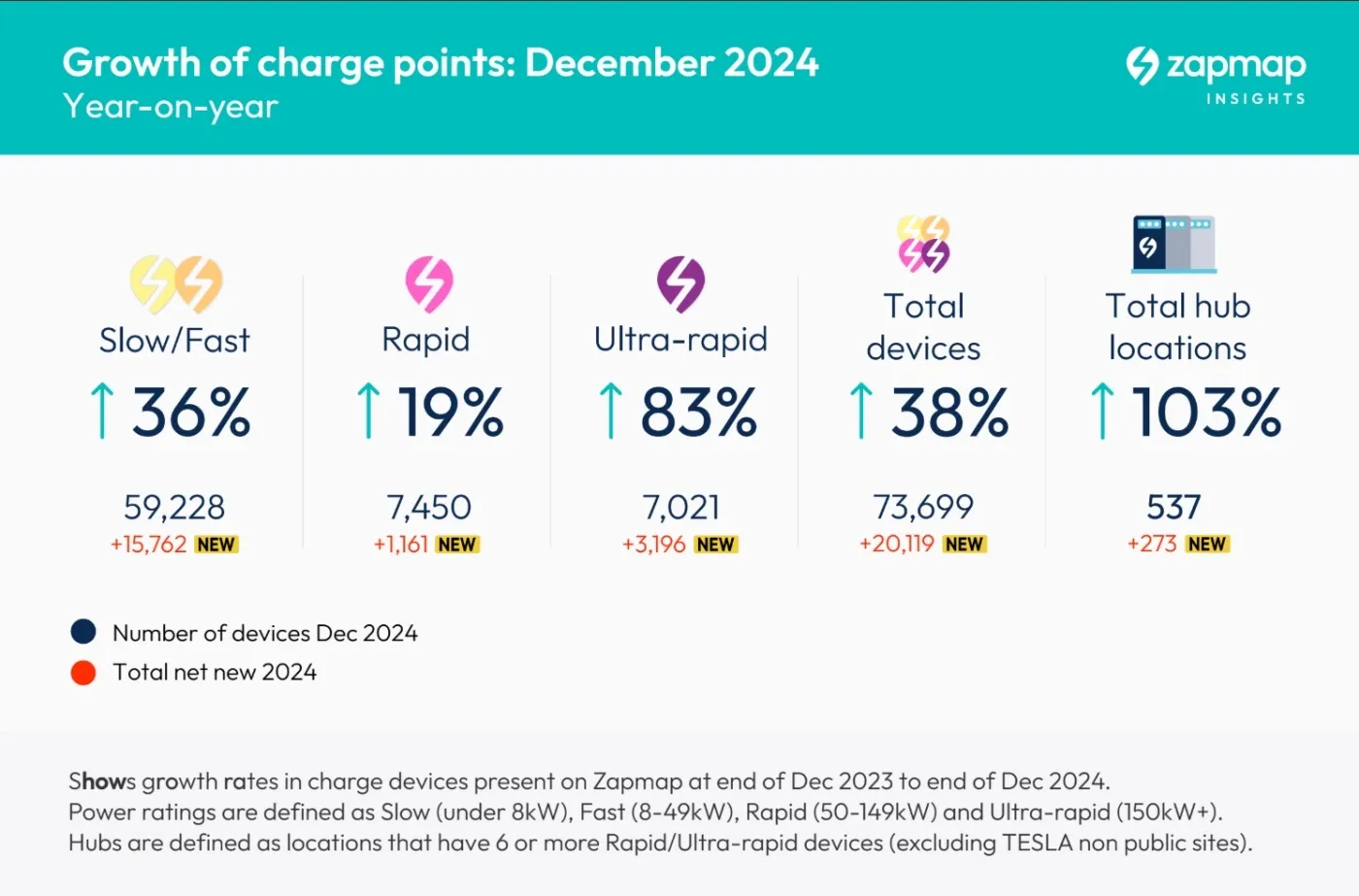

Charging infrastructure growth

With EV sales penetration rates rising in most countries, it is vital that charging infrastructure expansion keeps pace. However, despite a healthy 33% expansion in the global number of public charge points in 2024, the ratio of EVs to public charge points deteriorated slightly. This was mainly down to growth in EV sales outstripping infrastructure expansion in China – the world's biggest market – and the Americas, with charging sufficiency largely unchanged in most other regions.

Meanwhile, the share of fast DC charge points continues to steadily grow. The total number of public charge points in the sample countries grew by more than 30% from 3.8 million at the end of 2023 to more than 5 million by the end of 2024.

Notably, more than two thirds of the charge points added in 2024 are in China. While some European countries continued substantial infrastructure rollouts (particularly Belgium, Germany, Spain, and the UK), some relatively mature markets, such as Norway, saw more limited growth.

In North America, growth was also modest at just above 20%, while it was lower still in the likes of Japan and South Korea. Meanwhile, some relatively early-stage markets, such as the GCC states and Southeast Asia, continued to see rapid growth, albeit from a low base of charge points.

Overall, AC technology remains the basis for the majority of public charge points (60% globally), but the share of DC chargers is increasing. There is some regional variation here: less than 20% of European public charge points are DC, but this rises to more than 40% in Asia-Pacific and the Middle East and North Africa.

Europe: Continued rollout with gradual growth in public DC charging

The number of public charge points increased by more than 35% in 2024, while the total number of public charge points now exceeds one million across Europe, of which more than 150,000 are DC.

There was also continued growth in the number of private charge points, meaning Europe's total charge-point count grew from approximately seven million to more than nine million in 2024.

Innovation in charging technology is also becoming more widespread. Battery swapping is now available in numerous countries, with NIO opening stations in Scandinavia, Germany, and the Netherlands. Smart charging and vehicle-to-grid pilot schemes are also underway across Europe.

North America: Modest rollout in the face of uncertainty

Growth in the number of public charge points was more modest in North America, likely reflecting political headwinds and uncertainty in the United States, and the broader challenges faced by some charge point operators.

Total charge points increased by a little over 20% during 2024, in line with 2023 but short of 2024 growth rates in Europe and Asia-Pacific.

However, DC public charge points now account for around 25% of all public charge points – an increase of 30% during 2024. This hints at the stronger need for faster public charging in the likes of the US and Canada, where a high share of drivers have access to private charging at home and where driving distances are relatively high given the size of countries.

Asia-Pacific: China fuels growth, while young markets take off

Growth in total charging capacity continued at pace. Driven almost entirely by China, the total number of charge points in the Asia-Pacific countries in the study increased by more than 40% to 13.5 million. Of these, just under four million are publicly accessible, with 45% DC. Public policy, state-backed expansion, and corporate partnerships helped drive more than 30% growth in public charge point numbers in China, with a 35% increase in public DC charge points.

Less mature markets such as Indonesia and Malaysia are seeing rapid growth rates, albeit from a very low base, while Japan and Korea – two of the region's largest in terms of public charge point numbers – continued to lag behind in terms of growth rate.